What We Offer

Drug Store Insurance in California

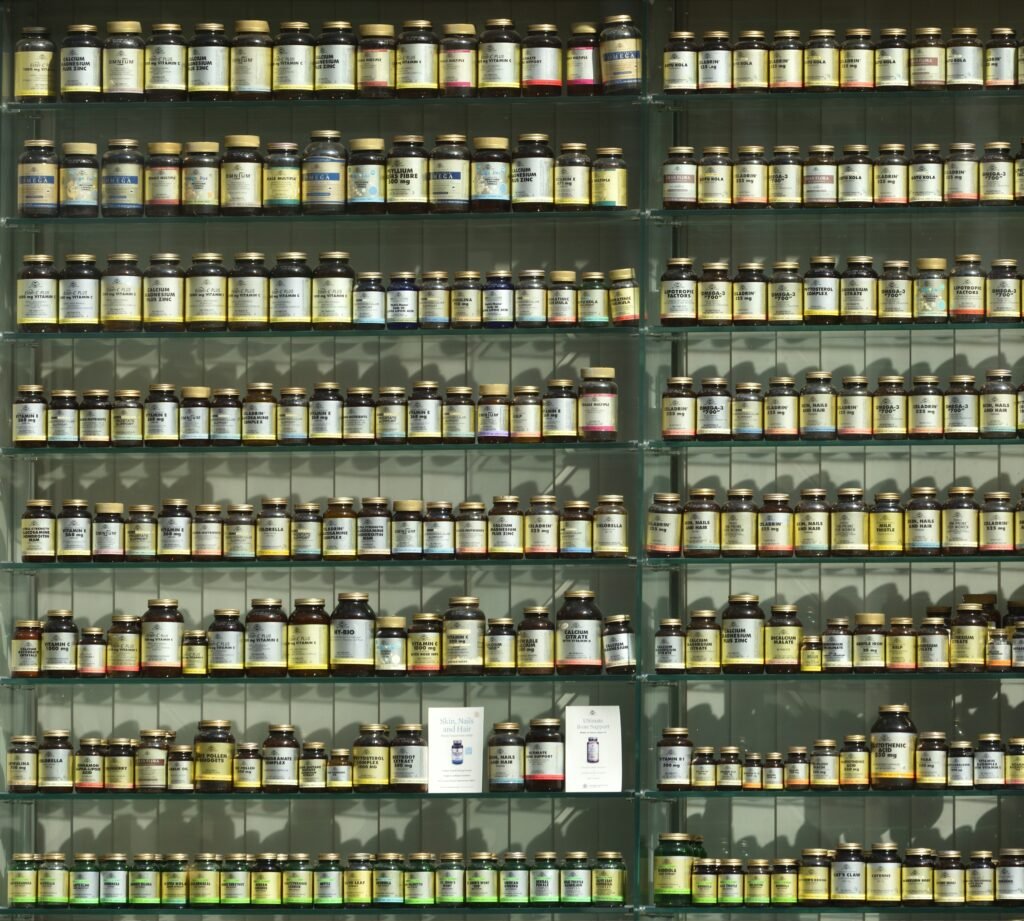

Owning and operating a drug store involves much more than stocking shelves with medications and wellness products. From customer safety to handling sensitive pharmaceuticals, your store faces unique risks that require strong financial protection. Drug store insurance in California and across the USA is designed to safeguard your business from liability claims, property damage, theft, and employee-related risks. With the right coverage in place, you can focus on supporting your community’s health without worrying about unexpected losses.

Every drug store is exposed to risks such as slip-and-fall accidents, prescription errors, and product liability claims. Without proper insurance, even a small incident could lead to costly lawsuits or regulatory penalties. That’s why tailored coverage is essential—not only to stay compliant but also to ensure your store continues running smoothly. Our policies are designed to address these specific risks so you can maintain trust with customers and stay financially secure.